“I’m betting on Paris as the major EU financial hub post-Brexit”

At 11pm tonight, the UK will leave the European Union. For many in the City of London who voted to remain, it will be a matter of extreme regret. Nothing will change immediately – the transition period lasts until the end of this year. This gives plenty of time for Paris to play for the position as the centre of EU finance.

“I am betting on Paris as major financial hub over other cities in Europe post Brexit,” says one JPMorgan MD in London, who’s moving to the French city. “I suspect it will take the majority of front office staff displaced by Brexit – most of the continental sales force and roughly 20% of traders across major banks.”

Plenty of banks have also chosen Frankfurt as their preferred location after Brexit.

Goldman Sachs, Morgan Stanley, Standard Chartered and UBS have all opted for the German city as the place for their EU-based trading activities and U.S. banks like Jefferies have been strengthening their investment banking activities there. However, the most recent report from thinktank New Financial said 69 firms have chosen Paris, versus 45 who chose Frankfurt. Bank of America already has 450 people in the eighth arrondissement, and JPMorgan recently announced plans to purchase BNP Paribas’s former Paris office at 21 Place du Marché Saint-Honoré, with the potential to house a similar number of staff.

U.S. banks’ expansion in the French market is already causing ripples locally.

Leo Lopes at Paris search firm Vendôme Associés said there’s some “tension” over compensation as U.S. banks hire in Paris and traders from London arrive in the French capital with exalted pay expectations.

For the moment, Lopes said candidates don’t come to him saying, “I want to work for a U.S. house,” and that the quality of the team they’re joining matters more matters more. However, one junior at Bank of America said the U.S. bank’s Paris office is becoming the place to work, not just in the French capital, but in Europe: “I feel extremely lucky and privileged to part of this experience at BofA in Paris, in a bank that is actually growing and has the ambition to gain market share in Europe.” Morale at the bank in Paris is high, he added: “People are very happy to work and live in France. The broker dealer is almost at cruise speed and we’re very optimistic for its success.”

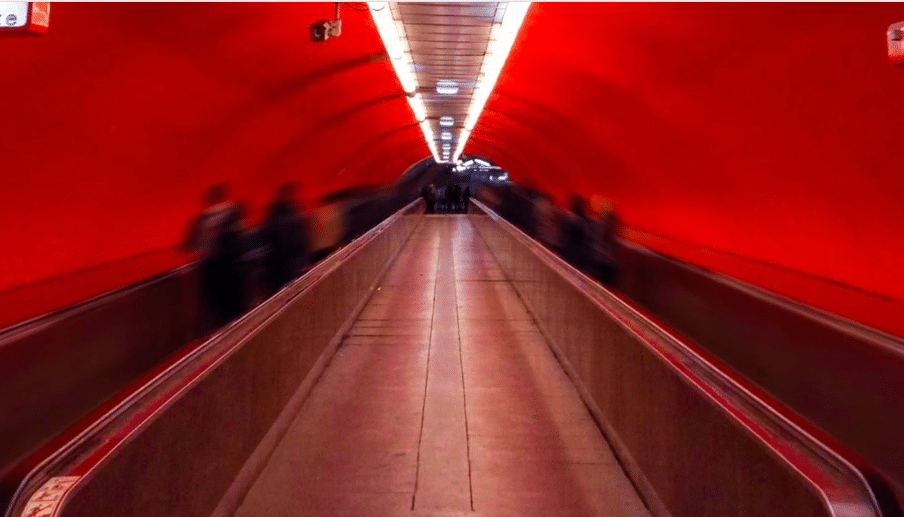

Of course, working and living in Paris has its downsides. There are taxes, although President Macron’s ‘expatriate tax regime’ can mitigate this for people moving to France from elsewhere. There are also street protests and there have been transport strikes. However, the JPMorgan MD says these are simply teething pains. “Strikes are a transitional cost to prepare France for the future, and are not a permanent factor to consider in long-term decisions.”

Paris is better able to seize the title of Europe’s financial centre than rivals, he adds: “It will take years for Paris to match London in what London offered, but other European cities have even bigger hurdles. This includes Frankfurt, which is simply too small.”

Article by Sarah Butcher.

“I’m betting on Paris as the major EU financial hub post-Brexit” (efinancialcareers.fr)